north dakota sales tax nexus

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275There are a total of 458 local tax jurisdictions across the state collecting an average local tax of 222. In Arkansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Sales Tax Software Tax Software Sales Tax Tax Services

Counties in Iowa have the option to impose a local tax.

. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. The total sales tax rate in any given location can be broken down into state county city and special district rates. California has a 6 sales tax and Santa Clara County collects an additional 025 so the minimum sales tax rate in Santa Clara County is 625 not including any city or special district taxes.

South Dakota Documentation Fees. This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. It is free printable and will become a go-to guide for you and your frequently asked.

Average DMV fees in South Dakota on a new-car purchase add up to 48 1 which includes the title registration and plate fees shown above. Several examples of exceptions to the sales. Combined with the state sales tax the highest sales tax rate in South Dakota is 75 in the.

This means that depending on your location within Iowa the total tax you pay can be significantly higher than the 6 state sales tax. 712015 repealed effective 812019. 98201 98203 98206 98207 and 98213.

Florida has a 6 sales tax and Lee County collects an additional 1 so the minimum sales tax rate in Lee County is 7 not including any city or special district taxes. This page discusses various sales tax exemptions in Arkansas. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

Click here for a larger sales tax map or here for a sales tax table. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. An alternative sales tax rate of 105 applies in the tax region Snohomish-Ptba which appertains to zip code 98204.

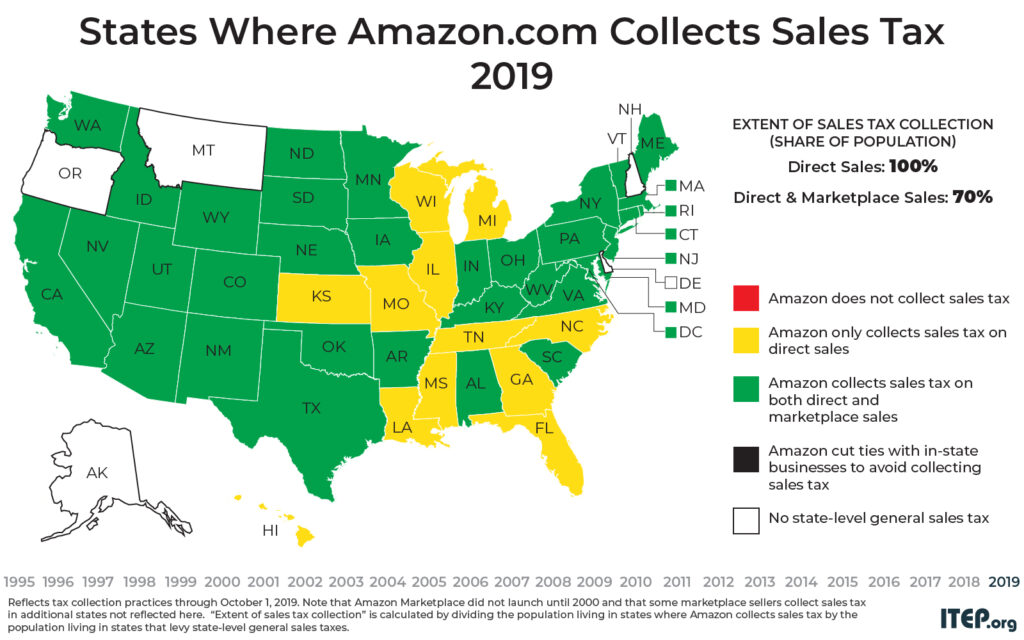

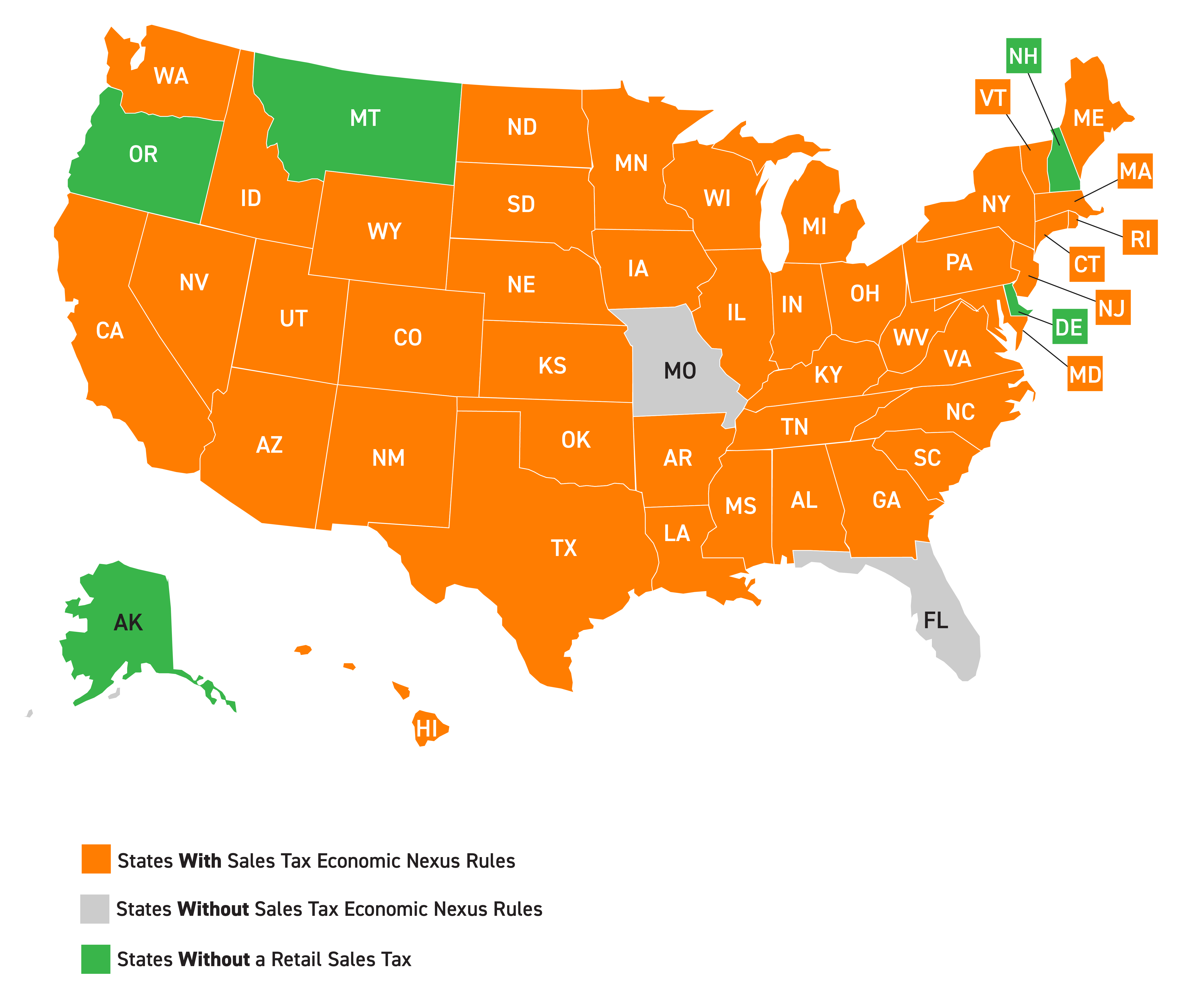

Amazons tax behaviours have been investigated in China Germany Poland Sweden South Korea France Japan Ireland Singapore Luxembourg Italy Spain United Kingdom multiple states in the United States and Portugal. Sales into North Dakota exceeding 100000 or sales were made in 200 or more separate transactions in the current or last calendar year. Are services subject to sales tax in Iowa.

Combined with the state sales tax the highest sales tax rate in Ohio is 8 in the cities of. Click here for a larger sales tax map or here for a sales tax table. This table shows the total sales tax rates for all cities and towns in.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Average DMV fees in Massachusetts on a new-car purchase add up to 80 1 which includes the title registration and plate fees shown above. Click here for a larger sales tax map or here for a sales tax table.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. How to use sales tax exemption certificates in Georgia. According to a report released by Fair Tax Mark in 2019 Amazon is the best actor of tax avoidance having paid a 12 effective tax rate between 2010-2018 in.

Economic Nexus Threshold. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Demystify sales tax nexus with the 5 Things to Understand About your Nexus Footprint white paper. While the Arkansas sales tax of 65 applies to most transactions there are certain items that may be exempt from taxation. The 2018 United States Supreme Court decision in South Dakota v.

Combined with the state sales tax the highest sales tax rate in North Carolina is 75 in. The 2018 United States Supreme Court decision in South Dakota v. North Carolina Documentation Fees.

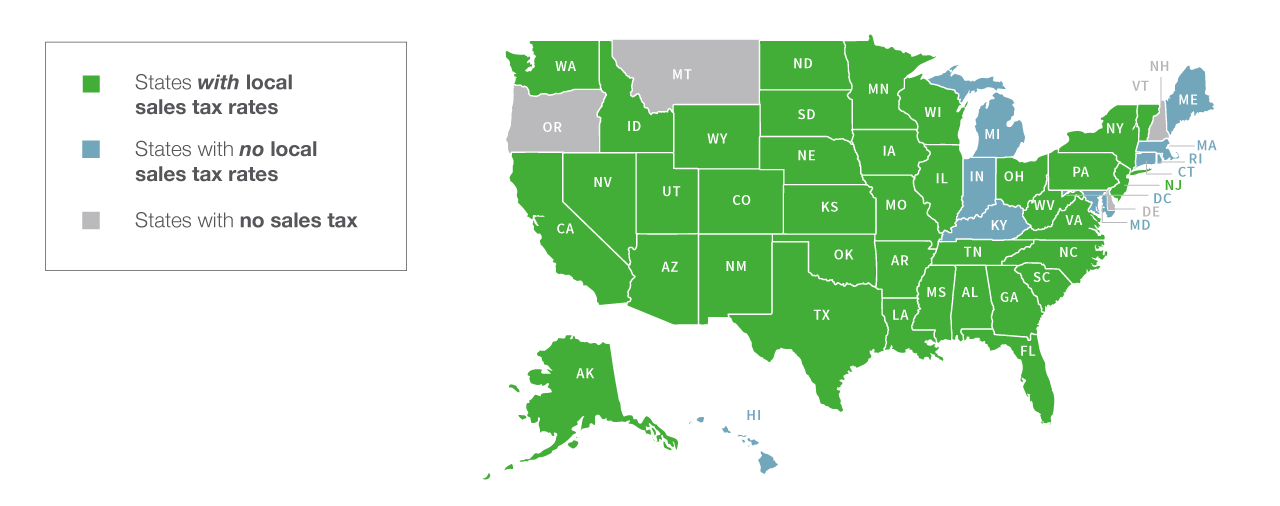

How to use sales tax exemption certificates in New Jersey. Utah has a 485 statewide sales tax rate but also has 125 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2114 on top of the state tax. The sales tax is paid by the purchaser and collected by the seller.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. You can read about North Dakotas economic nexus law here. Has impacted many state nexus laws and sales tax collection requirements.

Every state with a sales tax has economic nexus requirements for remote out-of-state sellers following the 2018 South Dakota vWayfair decisionEconomic nexus generally requires out-of-state sellers to register and collect and remit sales tax once they meet a set level of sales or number of transactions within. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Ohio is an origin state.

Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225There are a total of 576 local tax jurisdictions across the state collecting an average local tax of 1504. 712015 repealed effective 812019. North Dakota sales tax is comprised of 2 parts.

You can find guidance on economic nexus from the North Dakota State Tax Commissioner here. Iowa has a 6 statewide sales tax rate but also has 833 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0988 on top of the state tax. After June 30 2019 those remote sellers may cancel their North Dakota sales and use tax permit and discontinue collecting North Dakota sales tax.

An alternative sales tax rate of 106 applies in the tax region Mill Creek which appertains to zip code 98208. Sales Tax Exemptions in Arkansas. An example of items that exempt from Nebraska sales tax are certain kinds of prescription medications and some types of medical devices.

This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. Look up 2022 sales tax rates for New York New York and surrounding areas. Economic Nexus State by State Chart.

However it is important to note that any business in the service industry that creates or builds a tangible product will be required to pay sales tax. Massachusetts Documentation Fees. South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6There are a total of 290 local tax jurisdictions across the state collecting an average local tax of 1817.

This table shows the total sales tax rates for all cities and towns in Lee County including all local. 1012018 see state notice. Has impacted many state.

North Dakota imposes a sales tax on retail sales. The Everett Washington sales tax rate of 99 applies to the following five zip codes. This means that an individual in the state of Nebraska who sells computer games and video games would be required to charge sales tax but an individual who owns a store which sells medical devices is required.

Tax rates are provided by Avalara and updated monthly. If your business is part of the service industry you have no tax obligation in the state of Iowa. Look up 2022 sales tax rates for Charlotte North Carolina and surrounding areas.

Gross receipts tax is applied to sales of. Ohio considers a seller to have sales tax nexus if. Average DMV fees in North Carolina on a new-car purchase add up to 28 1 which includes the title registration and plate fees shown above.

North Carolina has a 475 statewide sales tax rate but also has 458 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax.

Shopify Sales Tax Economic Nexus Requirements For 2022

Sales Tax After Wayfair V South Dakota The Legalpreneur Sales Tax Tax Business

2019 Internet Sales Tax Updates For Economic Nexus

Sales Tax Just Got A Lot More Complicated Are You Ready

Sales Tax Collection Tips Ten Quick Tax Rules To Help With The Murkiness Of State Taxes If You Need More Help Visit Our Sales Tax Tax Rules Tax Preparation

Nexus Chart Remote Seller Nexus Chart Sales Tax Institute

What Prompted Sales Tax Nexus Filing Taxes Tax Nexus

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

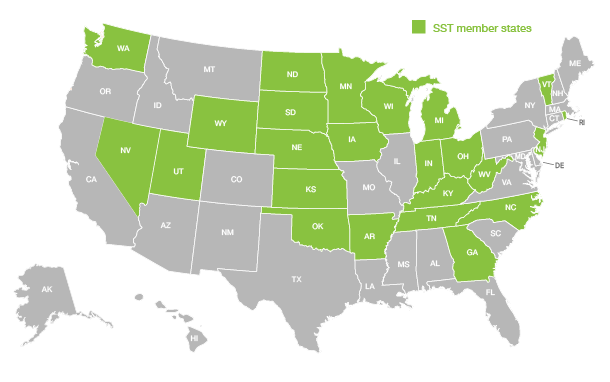

Economic Nexus And Streamlined Sales Tax Sst

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

How To Charge Sales Tax In The Us 2022

Economic Nexus By State For Sales Tax Ledgergurus

What Is Sales Tax Nexus Learn All About Nexus

Sales Tax Nexus 5 Signs Your Company May Owe Taxes In Other States Stage 1 Financial

North Dakota Sales Tax Quick Reference Guide Avalara

How Do State And Local Sales Taxes Work Tax Policy Center